Best Time to Buy and Sell Stock — From Brute Force to One-Pass Insight

Overview

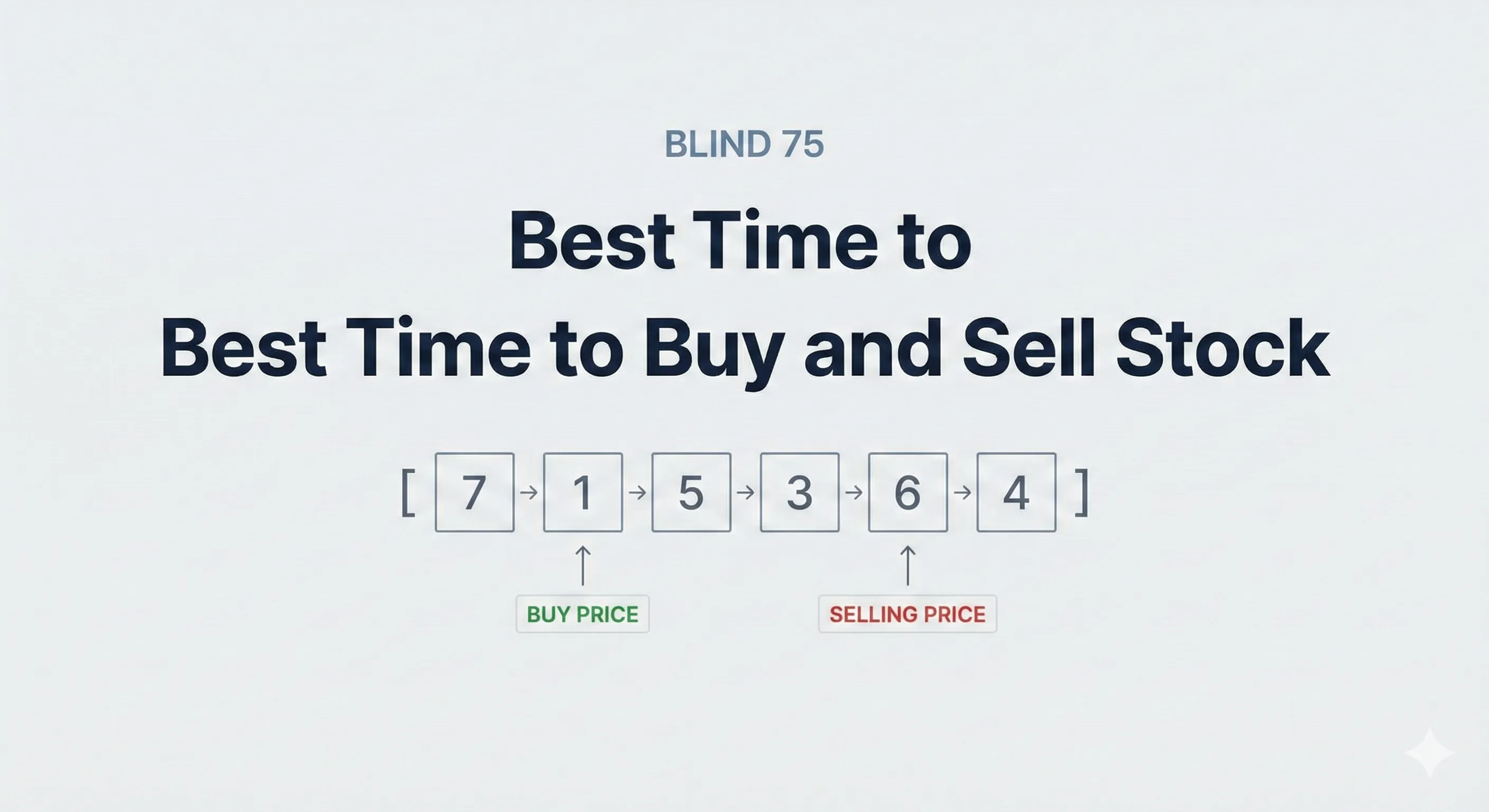

You’re given a list of stock prices where each index represents a day. You are allowed only one transaction:

- Buy on one day

- Sell on a future day

Your goal is simple: maximize profit.

If no profit is possible, return 0.

Problem Constraints

1 <= prices.length <= 10^5- Expected time complexity: O(n)

- Only one buy and one sell

- Sell must happen after buy

How I Approached the Problem

I follow a strict rule when solving problems like this:

- Make it work

- Then make it fast

So I deliberately explored multiple approaches—even incorrect ones—to understand what doesn’t work and why.

Brute Force Approach

The most straightforward idea:

- Try every possible buy day

- Try every possible sell day after it

- Track the maximum profit

Code

class Solution {

public:

int maxProfit(vector<int>& prices) {

int profit = 0;

int n = prices.size();

for (int buy = 0; buy < n; buy++) {

for (int sell = buy + 1; sell < n; sell++) {

profit = max(profit, prices[sell] - prices[buy]);

}

}

return profit;

}

};

Complexity

- Time: O(n²)

- Space: O(1)

Why This Fails

With n up to 10^5, this approach performs billions of comparisons.

It works logically—but fails practically due to TLE.

Failed Attempts (and Why They Matter)

Before landing on the optimal solution, I tried a couple of “clever” ideas. They didn’t work—but they taught me why the correct solution does.

Attempt 1: Two Pointer Approach

Idea:

- Buy pointer at the start

- Sell pointer at the end

- Move pointers based on price comparison

class Solution {

public:

int maxProfit(vector<int>& prices) {

int n = prices.size();

int i = 0, j = n - 1;

int profit = INT_MIN;

while (i < j) {

profit = max(profit, prices[j] - prices[i]);

if (prices[i] > prices[j]) i++;

else j--;

}

return max(profit, 0);

}

};

Why It Fails

- Prices are not sorted

- Valid buy–sell pairs are skipped

- Pointer movement is based on assumptions that don’t hold

This approach looks elegant but breaks under real input.

Attempt 2: Sell at Maximum Price

Idea:

- Find the highest price in the array

- Buy at the lowest price before it

class Solution {

public:

int maxProfit(vector<int>& prices) {

int n = prices.size();

if (n <= 1) return 0;

int maxSell = INT_MIN;

int maxSellIndex = 0;

for (int i = n - 1; i >= 0; i--) {

if (prices[i] > maxSell) {

maxSell = prices[i];

maxSellIndex = i;

}

}

int profit = 0;

for (int i = 0; i < maxSellIndex; i++) {

profit = max(profit, maxSell - prices[i]);

}

return profit;

}

};

Why It Fails

- Selling at the highest price doesn’t always give max profit

- The optimal buy–sell pair may happen earlier or later

Optimal Solution — One Pass

The Key Insight

You don’t need to know the future.

You only need two things:

- The minimum price so far

- The best profit so far

At each day:

- Assume you sell today

- Check if today’s price minus the lowest past price improves profit

Code

class Solution {

public:

int maxProfit(vector<int>& prices) {

int buy = prices[0];

int profit = 0;

for (int i = 0; i < prices.size(); i++) {

buy = min(buy, prices[i]);

profit = max(profit, prices[i] - buy);

}

return profit;

}

};

Complexity

- Time: O(n)

- Space: O(1)

Why This Works

- Buying always happens before selling

- The lowest price is tracked dynamically

- Each element is processed exactly once

- No unnecessary comparisons or assumptions

This is optimal in both theory and practice.

Final Takeaways

- Don’t jump straight to optimization

- Failed approaches clarify constraints better than successful ones

If you can explain why your failed solution failed, you understand the problem.

That’s the real win.